How to Claim Relief Fund in ITR 2021-22 Donee Name Donee PAN No Details Haryana Govt

How to Claim Relief Fund in ITR 2021-22 ? What to Fill in Column Donee Name , Donee Address, Donee PAN No , Address . All your quires get solved by visiting Finance Department Website Haryana Government . Latest on Website is recently Updated with Info for Claiming Fund Donated in Corona Relief Fund by Employee . Here are Credentials Please Check

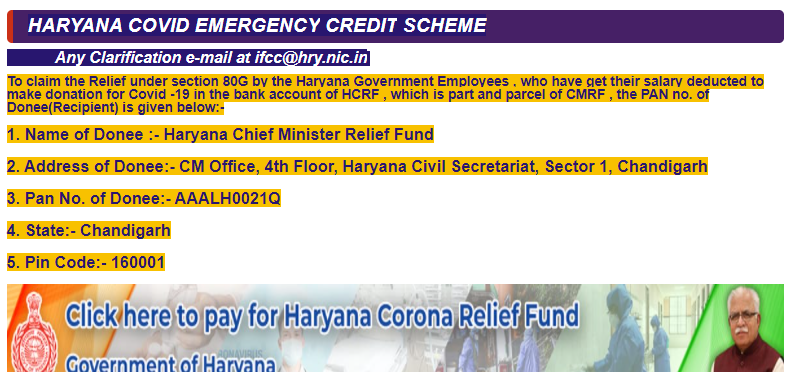

To claim the Relief under section 80G by the Haryana Government Employees , who have get their salary deducted to make donation for Covid -19 in the bank account of HCRF , which is part and parcel of CMRF , the PAN no. of Donee(Recipient) is given below:-

Particulars That are Required While Filling ITR

The donated amount will be eligible for 50% income tax deduction u/s 80G

Donation Entitled for 50% Deduction Without Qualifying Limit

Pan No. of Donee:- AAALH0021QName of Donee :- Haryana Chief Minister Relief Fund

Address of Donee:- CM Office, 4th Floor, Haryana Civil Secretariat, Sector 1, ChandigarhState:- ChandigarhPin Code:- 160001

Note - State Code Will Automatically Filled by Entering PIN Code

Any Clarification e-mail at ifcc@hry.nic.in

For More Details Follow Link http://www.finhry.gov.in/

How to Claim on Income Tax Website https://eportal.incometax.gov.in/

Login With your PAN No and Password to Income Tax new Website

And Under Corner Deduction

Under Column Deduction

Click on Add 80 G Button

Then Fill All Asked Particulars

Note : Please Add Double Amount of Form 16 in Column Donation in Other Mode ( E.g Here amount From 16 (i. Total Deduction in Respect of interest on loan taken for higher education under section 80 G) is equals to 3205 So we Enter Amount 3205 X 2 = 6410 in Column

That will be shown Automatically 50 % of Written .

If you want to financially support India in winning a war against COVID 19 pandemic, donations with the smallest of the amount can be directly made to PM CARES (Prime Minister's Citizen Assistance and Relief in Emergency Situations) Fund:

Name of the Account: PM CARES

Account Number: 2121PM20202

IFSC Code: SBIN0000691

SWIFT Code: SBININBB104

Name of Bank & Branch: State Bank of India, New Delhi Main Branch

UPI ID: pmcares@sbi

The donated amount will be eligible for 100% income tax deduction u/s 80G and can be made through any of these popular payment modes like Debit Cards and Credit Cards, Internet Banking, UPI (BHIM, PhonePe, Amazon Pay, Google Pay, PayTM, Mobikwik, etc.) or RTGS/NEFT.

Date: 20 May, 2021 | The Income Tax Department extends the following due dates

- Income Tax Return filing date extended to 30th Sep,21 from 31st July 2021.

- Form-16 issue date extended to 31st July, 2021 from 15th June, 2021.

- TDS return for Q4 can now be filed till 30th June,21 instead of 31st May,21.

Date: 01 May, 2021 | ITR last Date

Filing of belated return and revised return for FY 2019-20 (AY 2020-21), has been extended from 31st March, 2021 to 31st May, 2021.

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Comments

Post a Comment